At Remitly, we’re committed to making money transfers faster, easier, and more secure. That’s why we’re excited to introduce Interac e-Transfer® for our customers as both a payment method (sending from Canada) and a delivery method (sending to recipients in Canada). This trusted and widely used solution enhances the remittance experience by removing the need to input bank account details in Remitly, offering a seamless and efficient way to send money internationally.

Ensuring a fast, reliable, and secure money transfer experience is our priority at Remitly. In Q4, nearly 8 million customers trusted us to deliver for their loved ones, with over 92% of transactions arriving within an hour and more than 95% completed without the need for customer support*. These numbers reflect our commitment to making every transfer as smooth and hassle-free as possible. At the same time, we continue to invest in advanced security measures so customers can send with confidence, knowing their money will arrive safely.

Interac e-Transfer is one of Canada’s most trusted payment methods, used by 88% of eligible Canadians, who had 1.4 billion transactions between November 2023 and October 2024. By integrating this payment method, we’re offering a secure and familiar option that makes transfers even more convenient for our customers.

How It Works

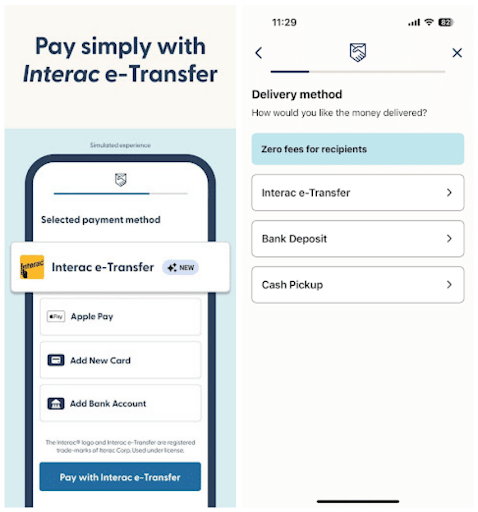

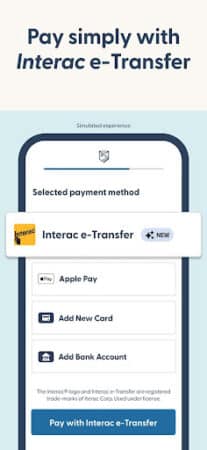

Sending with Interac e-Transfer as Payment

- Step One. When Selecting your Payment Method, choose Interac e-Transfer when sending money with Remitly.

- Step Two. Enter your Interac e-Transfer email or phone number —no need to input bank details.

- Step Three. Submit the transfer with Remitly; receive an email or SMS from Interac e-Transfer with a money request.

- Step Four. Accept the Interac e-Transfer money request, and your transfer is on its way.

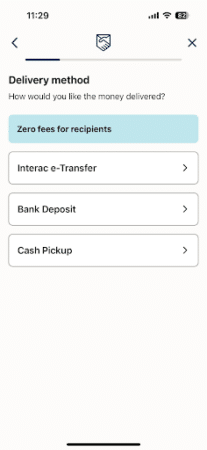

As a Delivery Method:

- Step One. The sender selects Interac e-Transfer as the delivery method, then enters the recipient’s phone number or email registered with Interac e-Transfer

- Step Two. The recipient receives a notification via email or SMS of an Interac e-Transfer transaction.

- Step Three. If the feature is set up, the funds will automatically be deposited in the recipient’s bank account.

Why This Matters for Customers

- A Trusted & Established Payment and Delivery Option. Remitly customers sending from Canada can now use Interac e-Transfer to pay for their international money transfers. Remitly customers sending to Canada can now use Interac e-Transfer as a way for their recipients in Canada to receive money.

- Secure and Reliable. Backed by robust security measures, which provides an added layer of protection to give customers confidence that their money is safe.

- Simple & Hassle-Free. Using Interac e-Transfer to pay for or receive a money transfer means customers can provide the associated email address or phone number instead of needing to enter bank account details.

Start sending money more conveniently and securely—try Interac e-Transfer with Remitly today! Download the Remitly app or visit our Newsroom to stay tuned for future updates!

*Q4 2024 Remitly Earnings data, page 6.